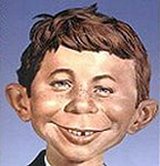

What, Me Worry?

The mad spenders are oblivious to the coming disaster

WashingtonTimes.com

Alfred E. Neuman, Mad magazine’s know-nothing icon, had the ready attitude toward disasters about to befall him: “What, me worry?” This could be the motto of congressional Democrats, who bring the same lackadaisical attitude to issues of government debt and federal spending.

Now we know why. At a recent roundtable hosted by the Progressive Democrats of America, Rep. Keith Ellison, Minnesota Democrat, said out loud what many of his colleagues privately think about spending and balancing the budget. “The bottom line is, we’re not broke. There’s plenty of money,” he told his fellow liberals. “It’s just that the government doesn’t have it.”

That neatly summarizes the outlook of the liberals, who lately have started calling themselves progressives, having so thoroughly soiled an honorable old word. They think money belongs to the government, not to the men and women who earned it: The government has the right to take the money of those who earned it and redistribute it to wherever the politicians want to put it to “better” use.

Mr. Ellison proposes to raise $350 billion through his Inclusive Prosperity Act, which imposes a transaction tax on the trading of stocks, bonds and derivatives. “It’s more than a simple revenue generator,” explains Mr. Ellison, “it’s a market regulator.” Businesses out of favor would pay the levy, and new spending programs would bestow benefits on the favored. The bill’s supporters call this the “Robin Hood Tax.”

It’s meant to be a populist strategy. “People know that we bailed out Wall Street,” says Mr. Ellison, “they resent the fact that we didn’t bail them out. We got some ‘come back’ coming back.” Except that the money won’t actually come back to taxpayers — it may not even be used in the United States at all. A sizable chunk will be used to back federal spending programs, including “global warming” initiatives and foreign-aid programs.

Mr. Ellison’s tax on stocks begins at 0.5 percent, 0.1 percent on bonds, and 0.005 percent on derivatives or other investments. These obviously are just the opening figures. Once such taxes are put in place, they would inevitably rise to meet the growing demands to spend more money. As government takes more, it spends more, digging the country deeper and deeper into debt. It’s why the nation is already $16.7 trillion in the red.

The financial-transaction tax isn’t atop the president’s agenda, not yet, but it’s in favor in Europe and with an array of liberals, including Paul Krugman, Bill Gates, Warren Buffett, George Soros and others who already have far more money that they could ever spend. Mr. Ellison insists that with a Senate co-sponsor it “has a chance at viability.”

The scheme offers a glimpse into the mindset of the mad spender who never sees a need to restrain the appetite of the government because in the mad spender’s view, the government is entitled to take whatever it wants from the people. There will be a payday someday, and it may be soon upon us. Alfred E. Neuman has the answer for that. “What, me worry?” He is, after all, an amiable dunce.