Five Lessons for Deficit Busters

A recent study of successful deficit reductions

found they averaged more than $5 in spending cuts

for every $1 in tax hikes.

By MICHAEL J. BOSKIN

WSJ.com

Bipartisan budget negotiations to raise the debt ceiling are focused on deficit reduction. That's progress. It's imperative that we rein in spending given the risks posed by our growing debt, ongoing deficits and President Obama's spending binge. But we should be wary of "balanced" spending-cut/tax-hike proposals promising phony future savings. Lawmakers should pay heed to five vital lessons from the history of attempts to consolidate the budget and reform major programs:

1) Cut spending, don't raise taxes. In a comprehensive study of post-World War II fiscal consolidations in developed economies published last year by the National Bureau of Economic Research, economists Alberto Alesina and Silvia Ardagna conclude that successful deficit reduction averaged $5 to $6 in spending cuts for every $1 of tax hikes. Higher taxes more often led to recession. President Obama's and Senate Budget Committee Chairman Kent Conrad's proposals to balance spending cuts with large tax hikes are thus a recipe for failure.

2) Control spending with enforceable procedures. President Reagan twice negotiated large spending cuts in exchange for modest tax hikes (after historic tax-rate reductions in 1981), but much of the spending control never materialized. The Gramm-Rudman-Hollings Act of 1985 required projections of gradual deficit decline to a balanced budget over several years. Not surprisingly, the result was rosy forecasts but little deficit reduction. So lawmakers revised and stretched out the targets, but fared no better.

Similarly, the European Union's Stability and Growth Pact, which in 1997 set deficit and debt limits, was routinely violated long before the current financial crisis and recession.

Some state balanced-budget rules have succeeded by requiring that any shortfalls be made up the following year, thereby decreasing the incentive to fudge in the first place. President George H.W. Bush's controversial 1990 budget deal with a Democratic Congress included caps on discretionary spending and sequestration of funds if they were exceeded. President Bill Clinton and a Republican Congress later renewed the rules. New entitlement programs and tax cuts had to be "paid for"—i.e., there was a "marginal balanced budget" requirement.

3) Be wary of baselines and

budget gimmicks. Projected savings are usually

measured from baselines with rapid increases in

spending and rising taxes. The current Congressional

Budget Office baseline assumes large automatic tax

hikes, far beyond historic GDP shares. The hikes

come from the expiration of the Bush tax cuts in

2013, growth of the Alternative Minimum Tax, and

continuing "bracket creep," which pushes

middle-income families into higher tax brackets.

That's how President Obama can call a large tax

increase (from today) a tax cut (from baseline).

Conversely, propose slowing projected spending growth (say, to 6% from 7%, as the House Republican Budget Resolution did this year) and you are accused of draconian slashing. We should end autopilot budgeting, and force justification of all spending or tax hikes.

4) Watch out for unintended consequences. Surprises tend to compound and, as Albert Einstein once said, compound interest is the most powerful force in the universe. In the 1970s, with little analysis or discussion, Social Security benefits at retirement were indexed to wage rather than price growth. Because wages generally grow more quickly than prices, price indexing has led to a higher rate of benefit growth. Today, with the baby boomers retiring, wage indexing creates trillions of dollars of future unfunded Social Security liabilities by projecting large benefit increases far beyond tax revenues. Switching to price indexing would eliminate this deficit while maintaining the real level of benefits.

Perhaps an even riskier consequence derives from the explosion, under Democratic and Republican administrations, in the number of people paying no income tax, in part because of refundable tax credits. Last year a majority of Americans paid no income tax. What is really unbalanced is the current revenue system. Partly due to the aftermath of the severe recession, transfer payments are at an all-time high as a share of personal income. These are ominous trends for budget dynamics in a democracy. We need both a broader base of economic activity and a larger fraction of the population financing government spending if we are to preserve a prosperous capitalist democracy.

5) Tackle fundamentals. If spending is projected to grow exponentially, President Obama's proposed temporary freeze on one-sixth of the budget, or even modest cuts, won't help much. We need changes that compound and cumulate over time, especially in Social Security and Medicare, or they will crowd out all other federal spending or drive marginal tax rates over 70%.

We've had successful, farsighted policy reforms that also dealt with pressing short-run issues. President Reagan's 1981 reform of indexing tax brackets to offset inflation still pays dividends by preventing even larger automatic tax hikes. The 1983 Greenspan Commission's phased-in gradual increases in Social Security retirement age were prescient. We can and must immediately address the debt-ceiling issue while focusing on long-term deficit reduction.

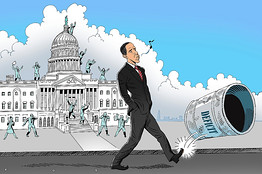

Events are rarely kind to those who keep kicking the can down the road, expanding spending and exploding the national debt. Payment ultimately comes from higher taxes, eroding the debt through inflation, or outright default and debt restructuring. The cost of any of these actions will be severe. Just ask taxpayers in Greece or Portugal facing a decade of depressed living standards. Or the Japanese, whose stagnation is measured in decades, not quarters or years.

Mr. Boskin is a professor of economics at Stanford University and a senior fellow at the Hoover Institution. He chaired the Council of Economic Advisers under President George H.W. Bush.