|

|

WND MONEY

Bachmann: I begged the Fed not to do it

Michele: 'Does anyone honestly believe adding inflation would be a good thing?'

By Joe Kovacs

WND.com

Fresh from her victory in last night's election, U.S. Rep. Michele Bachmann says she begged the Federal Reserve not to go ahead with controversial plans to monetize the national debt, and is calling its purchase of hundreds of billions of dollars in Treasury bonds "a disaster" for America.

The U.S. central bank, hoping to create growth in the sluggish economy, decided today to proceed with its scheme, buying $600 billion of federal government debt over the next eight months.

Officials also indicated they were ready to purchase even more bonds if inflation remained too low and unemployment too high.

"This is a very serious move by the Fed," Bachmann, a member of the House Financial Services Committee, told radio host Glenn Beck today. "What this means is intentionally the Federal Reserve will be spiking inflation. They think that's good for the country. Does anyone honestly believe adding inflation would be a good thing to the country? Well, the Federal Reserve does. This is a disaster."

"Every bit of it that they monetize the debt will mean a reduction in the value of the dollar," she added. "We're looking now potentially at losing 20 percent of the value of the dollar if they go forward with this. I wrote a letter several weeks ago to the Federal Reserve Chairman Ben Bernanke and begged him not to do this."

|

|

|

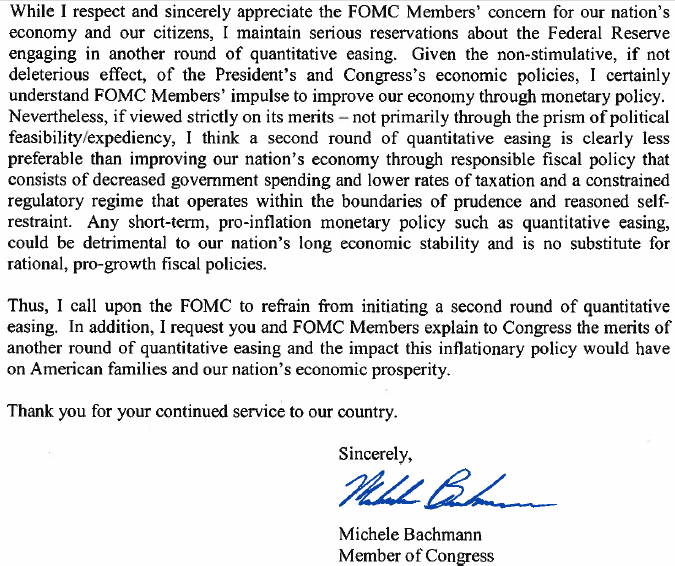

In her Oct. 14 letter, the Minnesota Republican told Bernanke the policy move was "clearly less preferable than improving our nation's economy through responsible fiscal policy that consists of decreased government spending and lower rates of taxation and a constrained regulatory regime that operates within the boundaries of prudence and reasoned self-restraint."

Today, Bachmann aired her fears, saying there's a long history of such action dating back into the early part of the 20th century.

"They have so devalued the dollar, that the dollar is worth about 4 cents what it was back in about 1915 and 1920 because of this issue of inflation. Government continues to overspend. When they overspend, they inflate the dollar and they pay their debt off with cheaper dollars. But they are literally robbing the sustenance out of every American because they're taking away the value of our dollar. And the people, of course, it will hurt the most are senior citizens."

For its part, the Fed said in its statement it was taking the action because the U.S. economy was still lackluster: "The pace of recovery in output and employment continues to be slow. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit."

The decision is not without dissent at the central bank, as Kansas City Fed President Thomas Hoenig voted against the tactic, fearing the risks outweigh any potential benefits.

"Hoenig also was concerned that this continued high level of monetary accommodation increased the risks of future financial imbalances and, over time, would cause an increase in long-term inflation expectations that could destabilize the economy," according to the Fed's statement.

Hoenig previously said while taking such action might work "in clean theoretical models, I am less confident it will work in the real world."

© 2010 WorldNetDaily