Taxes: A Defining Issue

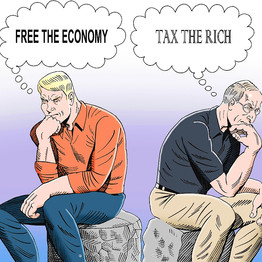

Barack Obama knows taxes define worldview. The GOP should offer voters an alternative.

By Daniel Henninger

WSJ.com

If the Obama presidency didn't exist, we would have to invent it.

At a time when the American people need to make some decisions about the nation's purpose, along comes Barack Obama to make the choices crystal clear.

In one corner of the world you have Europe, beset by a sovereign debt crisis that's been building for 50 years. The U.K.'s new prime minister, David Cameron, promises his people years of austerity to dig out from beneath their debt. Americans, staring at fiscal crevasses opening across Europe, have to decide if they also wish to spend the next 50 years laboring mainly to produce tax revenue to pay for public workers' pensions and other public promises. The private sector would exist for the public sector.

In another corner of the world, wealth is rising from the emerging economies of the east—China, India, Korea and the rest—posing America's greatest economic challenge in anyone's lifetime. Do the American people want to throw in the towel, or do they want to compete? If the latter, the public sector has to give way to the private sector.

One or the other. It's time to choose.

Barack Obama's first and biggest clarifier was his health-care plan. With Democratic majorities, it passed. Fair enough; they won the last election. But after a year spent watching the legislation, the American people said they didn't want a quasi-national health-care system. Support for the plan in the RealClearPolitics average is now 38.3%.

Now the clarifying gods have delivered a gift for the November election, the fight over taxes. Somewhere, George W. Bush must be laughing. Amid 9.5% unemployment, Democrats must deal with the expiration of the 2001 and 2003 tax cuts. They are trying to thread this needle by pushing a "middle class" extension through the hole, while impaling "the rich" on a tax spike.

In normal times, this tactic might work. But normal times are long past for America, and the voters know it. Mr. Obama himself talks all the time about the end of "business as usual." In the interests of the nation's future, Mr. Obama argues, the public economy needs to get bigger and stay bigger—currently 25% of GDP.

A big change indeed—unless the electorate decides this isn't what it wants for the next 50 years. That's another choice.

After the Democratic losses in November, the Republican winners will need more than their default status to replace Barack Obama's grand vision. The tax fight on offer is a chance to articulate a broader political vision that fits current anxieties about the national direction.

This is about something bigger than deficit reduction. The deficit is dangerous. But raising taxes to cut the deficit is a bailout for the spenders—until proven otherwise.

Barack Obama knows that the fight over the Bush tax cuts isn't about anything as arcane as a cyclical correction or "the deficit." He understands that taxes define a worldview. Mr. Obama could not have been clearer about this in his early 2009 budget preview, "A New Era of Responsibility: Renewing America's Promise."

Mr. Obama said the middle class had been "playing by the rules," while those "at the commanding heights" had not, benefiting from "huge tax cuts for the wealthy and well-connected." "It's a legacy of irresponsibility," he said, "and it is our duty to change it." He proposed "prudent investments" in health, education, infrastructure and clean energy. ObamaCare became one such "prudent investments."

This is tax policy by the sorcerer's apprentice. There is an alternative view.

The U.S. has never subscribed to the idea of a nation run by philosopher-kings. Even the Founders disassembled. The Obama White House, as with its new director of Medicare and Medicaid, Donald Berwick, is explicit in its belief that the smartest can design a nationwide health-care system for the rest—if the people will give them enough money to do so. And they could have designed a successful stimulus program—if the people had given them more than the piddling $862 billion they got.

This election and these times are a chance to put to the voters opposed visions of why we work and what we do with the money we earn.

If voters ultimately feel more secure with a Barack Obama and the like designing a national itinerary for some 300 million people in 50 states, then certainly one should vote for letting taxes rise now on one class of Americans and imposing a VAT next year on everyone. They need a whole lot of money, so give it to them to the horizon. We work, they decide.

The alternative vision is that to compete for the next 50 years, the U.S. is going to need a tax structure that keeps more of the nation's decisions about using its wealth in the hands—and minds—of millions of intelligent citizens, from any economic class. They work, they decide.

So: Extend the current tax rates for all and free everyone in an economy begging for the chance to be strong again. Yes, the U.S. economy will always be "strong," but it needs to be strong enough to take on all comers and win, which last time I looked was the real American way.

Write to henninger@wsj.com